Home Equity Loan Conveniences: Why It's a Smart Financial Move

Home Equity Loan Conveniences: Why It's a Smart Financial Move

Blog Article

The Top Reasons That Home Owners Choose to Safeguard an Equity Finance

For many home owners, choosing to secure an equity financing is a critical monetary decision that can use various benefits. The capability to take advantage of the equity integrated in one's home can offer a lifeline during times of financial demand or act as a device to accomplish specific goals. From consolidating financial debt to embarking on significant home improvements, the reasons driving people to opt for an equity loan are impactful and diverse. Understanding these inspirations can clarify the prudent monetary preparation that underpins such selections.

Financial Debt Debt Consolidation

Homeowners often select protecting an equity finance as a calculated financial action for financial debt combination. By leveraging the equity in their homes, individuals can access a round figure of money at a lower rates of interest contrasted to other kinds of borrowing. This funding can after that be utilized to repay high-interest financial obligations, such as credit score card balances or individual fundings, permitting property owners to enhance their monetary obligations into a single, more manageable regular monthly payment.

Financial obligation consolidation with an equity lending can supply several benefits to home owners. Firstly, it simplifies the settlement procedure by combining multiple financial debts into one, reducing the threat of missed payments and potential penalties. The reduced rate of interest rate associated with equity car loans can result in substantial price financial savings over time. Additionally, settling financial debt in this way can boost an individual's credit rating by lowering their overall debt-to-income ratio.

Home Enhancement Projects

Taking into consideration the improved worth and functionality that can be attained with leveraging equity, several people choose to allocate funds towards various home renovation projects - Alpine Credits. Home owners usually choose to protect an equity finance particularly for renovating their homes because of the considerable returns on financial investment that such jobs can bring. Whether it's updating outdated functions, expanding space, or enhancing energy effectiveness, home enhancements can not just make living rooms a lot more comfy however likewise raise the total value of the home

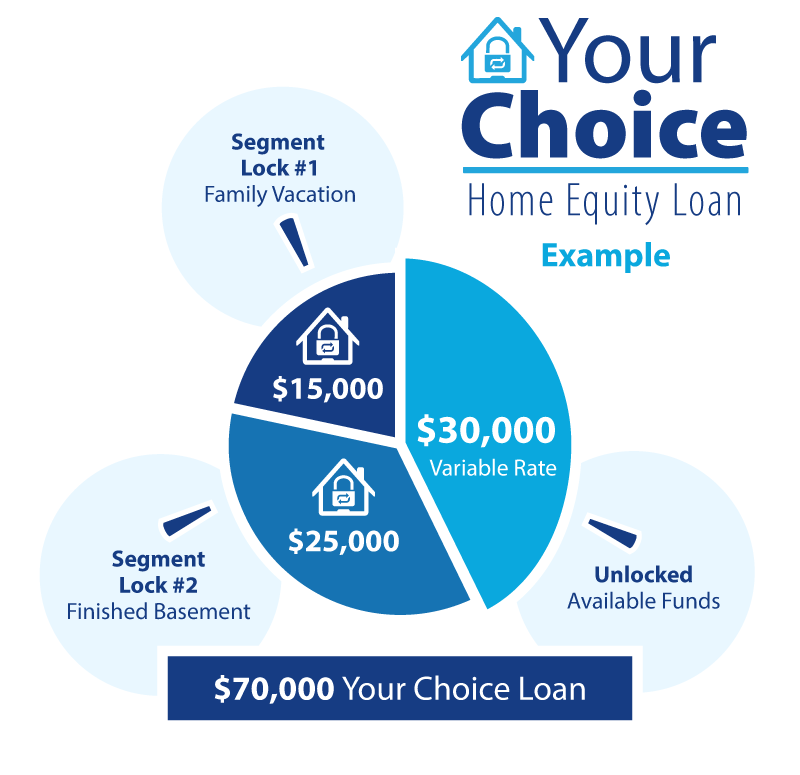

Common home renovation jobs moneyed with equity car loans consist of cooking area remodels, bathroom improvements, basement completing, and landscaping upgrades. By leveraging equity for home renovation tasks, house owners can create areas that far better fit their needs and choices while also making an audio monetary investment in their residential property.

Emergency Expenditures

In unforeseen scenarios where immediate monetary aid is called for, safeguarding an equity funding can supply house owners with a practical remedy for covering emergency situation expenses. When unanticipated events such as clinical emergency situations, urgent home fixings, or unexpected job loss occur, having accessibility to funds via an equity car loan can provide a safeguard for property owners. Unlike other types of borrowing, equity car loans generally have reduced interest rates and longer payment terms, making them a cost-effective alternative for resolving instant financial needs.

One of the crucial benefits of utilizing an equity funding for emergency costs is the rate at which funds can be accessed - Alpine Credits. House owners can rapidly use the equity constructed up in their building, enabling them to resolve pushing financial problems without hold-up. Additionally, the versatility of equity finances enables house owners to obtain just what they need, avoiding the problem of tackling too much financial debt

Education Financing

Amidst the search of higher education and learning, protecting an equity car loan can act as a calculated funds for property owners. Education and learning financing is a significant worry for several family members, and leveraging the equity in their homes can provide a method to gain access to needed funds. Equity car loans typically offer lower rates of interest compared to various other forms of lending, making them an appealing choice for financing education and learning expenses.

By taking advantage of the equity developed in their homes, house owners can access considerable amounts of cash to cover tuition charges, books, accommodation, and other relevant prices. Home Equity Loans. This can be especially useful for parents aiming to sustain their children with college or people looking for to advance their very own education. In addition, the passion paid on equity finances may be tax-deductible, giving potential economic advantages for debtors

Inevitably, utilizing an equity lending for education financing can help individuals invest in their future earning possibility and occupation improvement while properly handling their financial obligations.

Investment Opportunities

Final Thought

To conclude, property owners select to protect an equity car loan for various reasons such as financial obligation combination, home renovation jobs, emergency situation expenditures, education and learning financing, and financial investment chances. These finances supply a way for house owners to accessibility funds for vital financial needs and goals. By leveraging the equity in their homes, house owners can take benefit of lower rate of interest and flexible payment terms to accomplish their financial purposes.

Report this page